With over 1.1 million Australians making the switch to manage their own Self Managed Super Fund (SMSF), it is no surprise that it is a more popular option than ever for those wanting more control over their retirement savings and investments.

An SMSF places in your hands, the ability to fully control your retirement planning and investments. The long-standing debate when comparing SMSFs to traditional superannuation funds is typically based on a simple analysis of cost and returns; but in reality, it’s not that simple.

It ultimately comes down to your motivations, desire for control and your own personal retirement goals as a trustee.

An SMSF is not going to be suited to everyone – It must be considered on a case by case basis. But it is important to have all the facts and information at hand so you can make an informed decision.

“Lower fees, more control, better choice, more flexibility.”

So why choose an SMSF?

CONTROL

SMSFs allow trustees to take full control of their financial future. The need to gain greater control over superannuation assets and investments is the catalyst for the establishment of SMSFs in 2020. As a trustee, you are granted the responsibility of making the big decisions on where your money is invested. The control lies in your hands. Your money, your choice.

You take control of the fees, and the ability to generate higher returns. Trustees gravitate towards this sense of comfort, confidence and security in managing their own affairs.

FLEXIBLE INVESTMENT CHOICES

SMSFs are the ultimate providers of investment flexibility and choice. Not only do they offer shares, fixed interest and managed funds, SMSF’s can also offer increased flexibility, which gives trustees the opportunity to invest directly into property, commodities, unlisted companies, and unlisted managed funds and trusts. This can even include your own small business property.

The ability that SMSFs provide to create a diverse, tailored portfolio is unmatched when compared to institutional superannuation funds, and is extremely desirable to trustees.

DISSATISFACTION WITH YOUR EXISTING FUND

Taking control of an SMSF also means that trustees have oversight of their superannuation savings at all times. The decision to set up an SMSF usually comes from the trustees dissatisfaction with the current performance of their traditional superannuation fund. They may be unhappy with the rate of fees or the restricted investment options available to them. They may desire more transparency around the fees they are paying or want more control over things such as corporate actions.

PLAN YOUR TAX

SMSFs can provide additional flexibility when it comes to the tax paid by your fund. This flexibility enables individuals to control their contribution timing and the purchase/sale of investments to achieve the best retirement savings outcomes. SMSFs also provides a seamless transition from accumulation to pension phase.

PLAN YOUR ESTATE

If structured properly, and with thoughtful planning, an SMSF can provide additional flexibility and certainty regarding when, and to whom death benefits are paid from your retirement assets.

DID YOU KNOW?

- 8 out of 10 trustees believe their SMSF is good value for money.

- Approximately half of all trustees own or have owned a small business.

- 90% of trustees believe managing and engaging with their own SMSF provides them with a level of satisfaction.

- The median operating cost of SMSFs is around $3,923 a year.

- The majority of SMSF trustees spend between 1 and 5 hours a month administering their SMSF.

- The most common age range for establishing an SMSF is between 35 and 44.

- SMSFs are most cost effective at balances of $200,000 or more.

- Over 50% of trustees have had their SMSF for over 10 years.

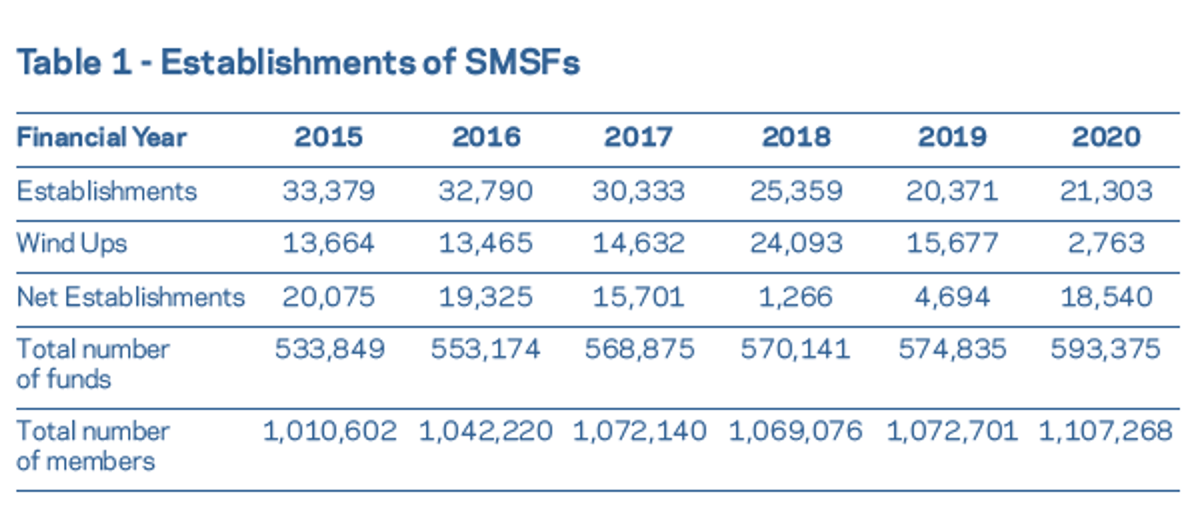

2020 saw the largest amount of funds (593,375) and members (1,107,268) to date.

With the efficiency and flexibility of SMSFs, also comes the strict regulations. Aside from the annual audit of your SMSF, which must be done by an independent Approved SMSF Auditor, you as the trustee can decide on the level of compliance and administration work that is outsourced to others – however, it remains ultimately your responsibility as the trustee to ensure your SMSF is compliant with tax and superannuation laws.

“Enjoy making decisions and the satisfaction of knowing the outcome is in your hands.”

At BIS Super, our SMSFA Specialist Advisers based on the Gold Coast, are here to help you with all aspects of your SMSF, from setup, to advice, administration and property and any complexities you may discover as a trustee.

For help with your SMSF, get in touch with us on 07 5598 3800 to talk to one of our Specialist Advisers.

Statistics courtesy of the SMSF Association